📖 Trade Horizons – Year-End Edition 2025

🌍 2025 Was Not Just Another Year — It Was a Structural Reset

A Ventrix Trade Introduced Opportunity for Family Offices, Asset-Backed Funds & Corporate Treasuries

🌍 2025 Was Not Just Another Year — It Was a Structural Reset

Why governments are reclaiming control — and how global capital must adapt

How intelligence is becoming the most powerful trading advantage

🌍 The New Economics of Sustainability

The world’s commodity markets are undergoing a structural shift.

How resource-backed assets are redefining financial power

🌍 The New Battlefield: Finance Meets Geopolitics Global

currency markets are entering a new age — where commodities,

not just central banks, are shaping the flow of economic

power. The dollar’s dominance, once unquestioned, now faces

growing challenges as resource-rich nations leverage their

commodities to strengthen local currencies and build

resilience against Western monetary systems.

For decades, global trade flowed predominantly along the North–South axis — developed economies exporting to the developing world.

But the tide is shifting.

🌍 The Future of Commodity Trading Is Going Digital

From copper to coffee, the world’s oldest trading system is undergoing its most radical transformation in a century.

The global energy map is being redrawn.

From oil and gas dominance to the rise of renewables, the world is entering a new energy order — one that blends hydrocarbons, clean tech, and critical minerals into a single investment frontier.

📖 Trade Horizons – Edition 05

As global liquidity tightens and traditional banks pull back from trade financing, a new financial order is emerging — powered by private capital, structured funds, and digital instruments.

As markets adjust to global uncertainty, one asset class is emerging as a strategic pillar: Commodities.

For institutional investors, UHNIs, venture capitalists, and family offices, commodities are no longer just trade goods—they are real assets that anchor portfolios and drive sustainable growth.

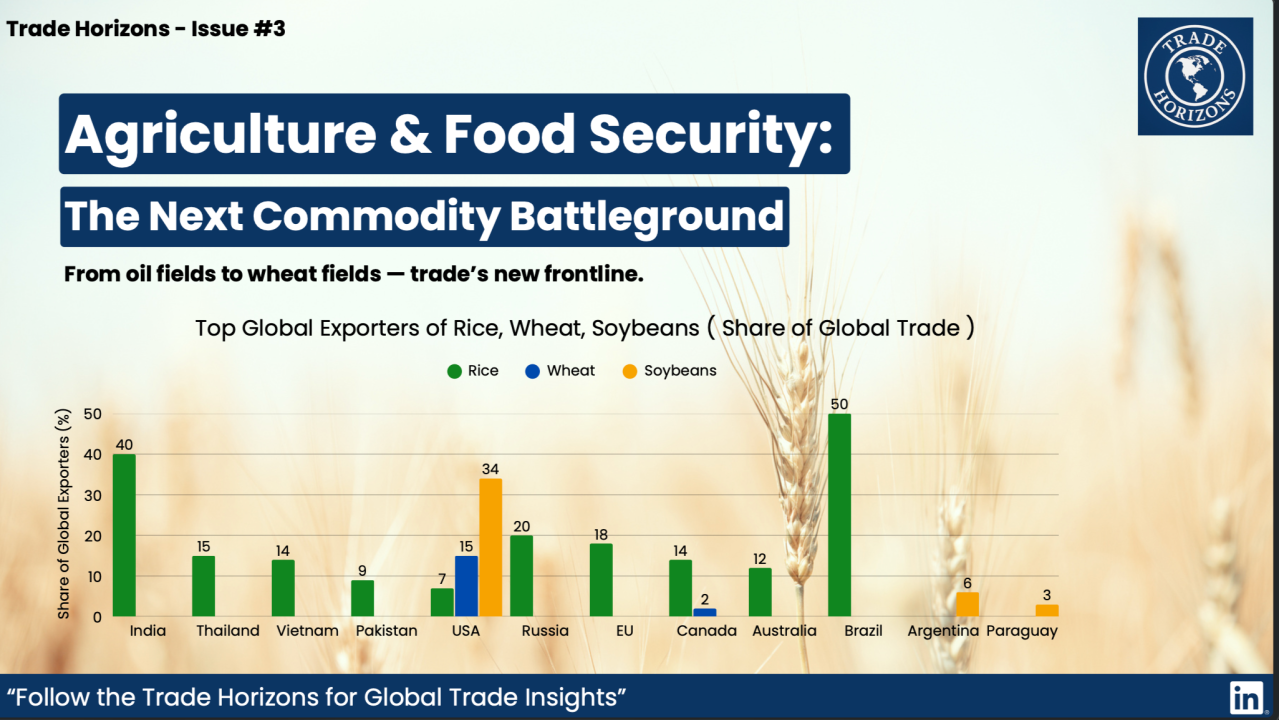

🌍 “Grain is the new oil. In 2025, food security is no longer just a domestic issue — it’s a global power game.”

🌱 Why Food Is Becoming Strategic

🔥 Opening Hook

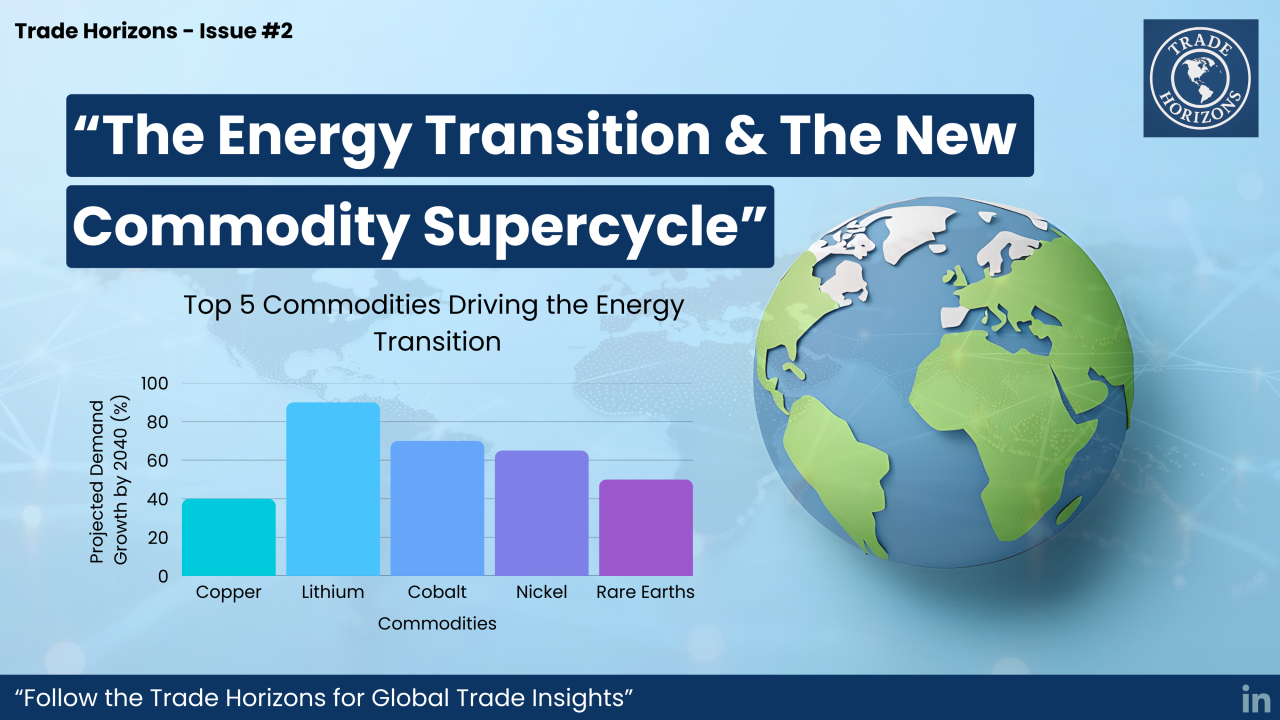

🌍 “The energy transition isn’t just about renewables. It’s triggering the biggest commodity supercycle in decades — reshaping demand, prices, and geopolitics.”

“Commodities Are the New Currency: Why Global Trade Is Rewiring in 2025”

🚨 Bold Take