⚡ Section 1 – Why Energy Transition = Commodity Shock

Net-zero commitments are driving record demand for clean tech metals.

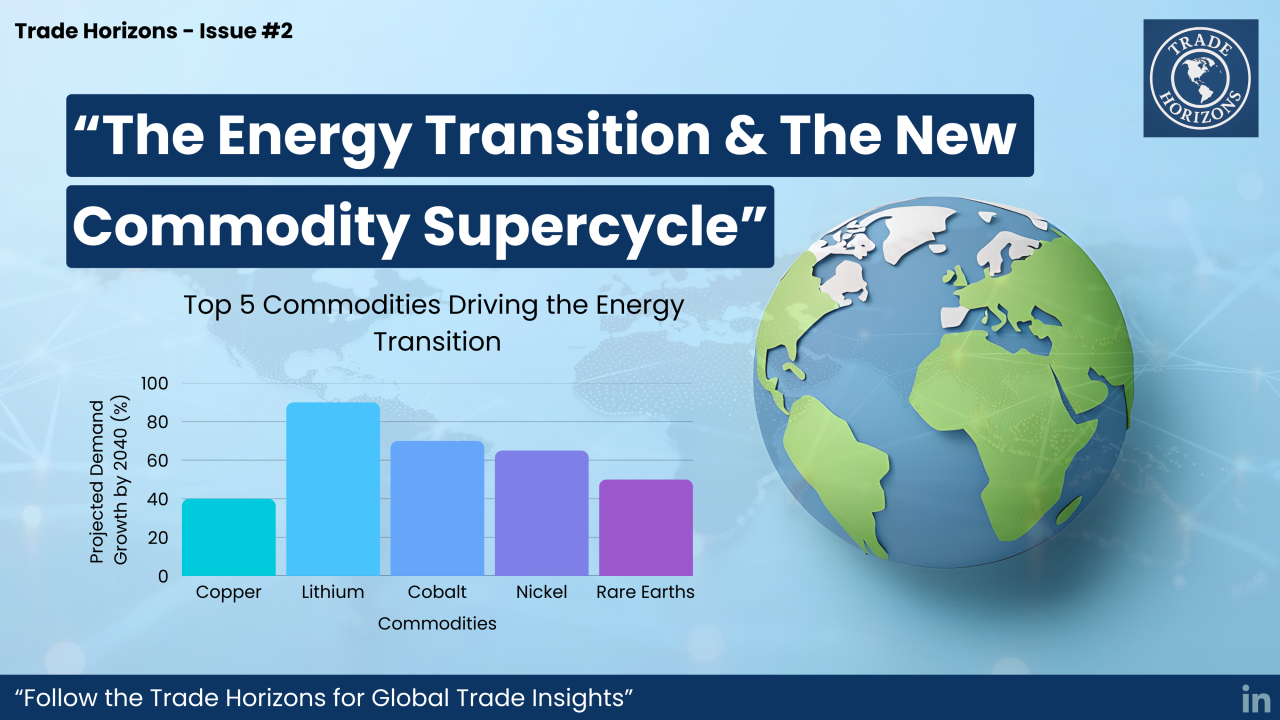

EVs → Lithium, cobalt, nickel.

Renewable grids → Copper, rare earths.

Infrastructure → Steel, aluminum, cement.

📊 Stat: The IEA projects demand for critical minerals to rise 4–6x by 2040.

-

⛽ Section 2 – Traditional Energy Still Matters

Oil & gas still supply 80% of global energy.

LNG & natural gas are positioned as “transition fuels.”

OPEC+ is navigating a balancing act in a carbon-conscious world.

⚡ Insight: Fossil fuels aren’t dying — they’re repositioning as bridge commodities. -

🏆 Section 3 – Winners & Losers in the Supercycle

Winners:

Copper: Chile, DRC

Lithium: Australia, Argentina

Rare earths: China

Oil & gas exporters: Middle East

Losers:

Heavy importers with no reserves (Japan, South Korea, parts of Europe).

📈 Investors are shifting portfolios into commodity-backed plays. -

🌪 Section 4 – Risks & Volatility

Geopolitical risk: China controls 70% of rare earths refining.

Climate shocks: Agriculture & hydropower face instability.

Capital flows: Financing + ESG scrutiny reshaping trade deals. -

💡 Closing Insight

📌 “The energy transition isn’t just green — it’s red hot with commodity opportunities. Those who anticipate the supercycle will control the future of trade.”

👉 Follow Trade Horizons – Global Commodity Insights for weekly deep dives into the forces shaping the new world economy.

#TradeHorizons #GlobalTrade #Commodities #EnergyTransition #SupplyChain # Ventrix Trade

Leads the company’s global vision, trade strategy, and technological innovation. His focus on sustainable partnerships and digital transformation drives Ventrix’s international success.